What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Interest Rates Soar Above 4%

Interest Rates Soar Above 4%

✉️ Want to forward this article? Click here.

Mortgage rates leapt up significantly this week, rising well above 4% for the first time in two years.

On Thursday morning, Freddie Mac reported 4.46 percent with an average 0.8 point as the average on a 30-year fixed-rate mortgage. Last week, rates averaged 3.93 percent. Long-term rates were last as this level in July 2011.

The rapid increase is consistent with a long-standing pattern that rates go up much faster than they inch down. But this move is exceptional.

“As a percentage basis, this is the largest increase in recorded history,” said DC-based mortgage consultant John Downs, who sees similarities to the 1990s.

“In 1992, the employment rate peaked at 7.8 percent with average 30-year rates of 8.94 percent,” he noted. “With some help from the Federal Reserve, long term rates began to drop steadily over two years to bottom at 7.15 percent as the unemployment rate fell to 6.6 percent. In early 1994, rates began a dramatic move higher, similar to today, increasing 1.5 percent in just five months and 2.2 percent over the course of that year. This was a reaction to a Fed policy change along with improving US economic fundamentals.”

“The last two years look very similar to 1992-1994; a time of Fed influence, decreasing interest rates and a slow growth economy. If the next six years resemble 1994–2000, we will have a period of great wealth through stable rates, rising home prices and a strengthening US economy.”

From Freddie Mac vice president and chief economist Frank Nothaft on today’s rates:

Following Fed chief Bernanke’s remarks on June 19th about the possible timing of reduced bond purchases, Treasury bond yields jumped over the week and mortgage rates followed. He indicated that the Fed may moderate the pace of its buying later this year and end the purchases around the middle of 2014.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

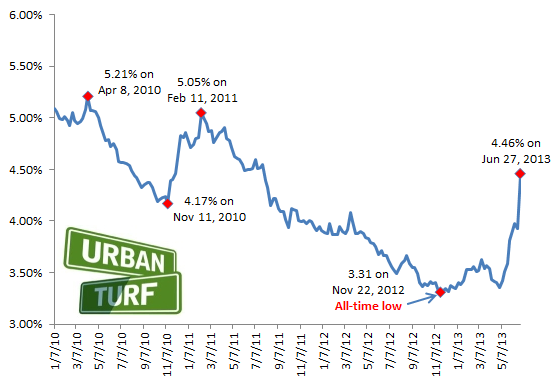

Here’s a look at the path of rates since January 2010:

This article originally published at https://dc.urbanturf.com/articles/blog/interest_rates_soar_above_4/7254.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro