Report: One in Three FHA Borrowers Would Benefit From Refinancing

Report: One in Three FHA Borrowers Would Benefit From Refinancing

✉️ Want to forward this article? Click here.

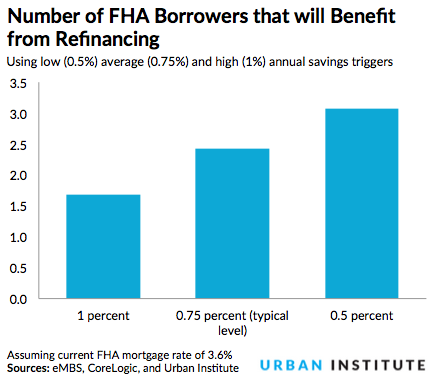

More than a third of homeowners who financed their purchase with an FHA loan could save money by refinancing, the Urban Institute reported on Monday.

An analysis by the think tank found that a recent cut to FHA mortgage insurance premiums could make refinancing a cost-saving measure for 2.4 million FHA borrowers. With mortgage rates as low as they’ve been in more than a year, refinancing is becoming a cost-saving option for many homeowners. And as we’ve previously noted, the FHA mortgage insurance premium drop could even make an FHA mortgage a more attractive option for a person looking to refinance a conventional mortgage.

The Urban Institute made its calculations based on how many FHA loans were eligible to refinance. That excludes borrowers on 15-year plans, along with those already eligible for a separate rate cut and those with “delinquent and modified” loans. Then it looked at whether or not it would likely make sense for the remaining homeowners to refinance, considering that most people will only undergo the (costly) process for savings of at least 0.75 percent on their annual mortgage costs. (Some people, the Institute noted, will be more aggressive; others, less so.)

The Institute’s estimate is also based on current FHA mortgage rates — which it notes may continue to fall, resulting in more potential refinances, or rise, resulting in less.

See other articles related to: fha, mortgage insurance, mortgage rates, refinancing, urban institute

This article originally published at https://dc.urbanturf.com/articles/blog/have_an_fha_loan_why_nows_a_good_time_to_refinance/9536.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro