What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

The Consequences of Poor Credit on Home Insurance Costs

The Consequences of Poor Credit on Home Insurance Costs

✉️ Want to forward this article? Click here.

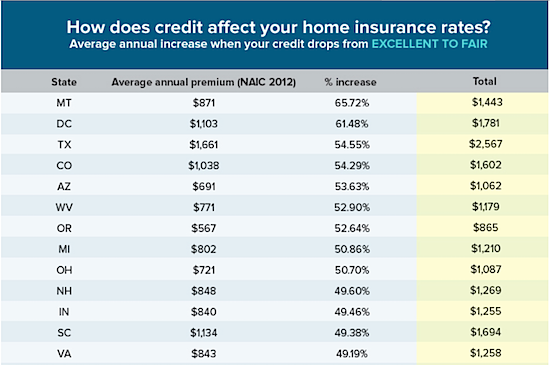

The role that credit plays in the cost of home insurance is significant, according to a new study.

The study commissioned by Insurancequotes.com, and completed through Quadrant Information Services, found that credit has a heavy hand on the home insurance an owner secures. Especially in DC.

story continues below

loading...story continues above

The cost gap between how much someone with excellent credit pays for home insurance versus someone with fair credit is 61 percent in the nation’s capital, according to the study. The gap grows to 185 percent when comparing the costs of a homeowner with excellent credit and one with poor credit.

Some activists are taking issue with how heavily credit factors in to the costs. Amy Bach of San Francisco-based nonprofit United Policyholders has long maintained that credit scoring primarily hurts low- to moderate-income earners, since they are the ones with typically lower credit scores.

“The damage that leads to many home insurance claims is often random, sudden and accidental — things like break-ins, slip and falls, or weather events,” Bach explained. “There is no way an individual’s credit score has a causal connection to those events.”

The full study can be viewed here.

See other articles related to: credit score, dc, home insurance

This article originally published at https://dc.urbanturf.com/articles/blog/difference_in_credit_scores_causes_huge_differences/10281.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro