What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Apartment Absorption Was Up in the DC-Area, Then COVID Arrived

Apartment Absorption Was Up in the DC-Area, Then COVID Arrived

✉️ Want to forward this article? Click here.

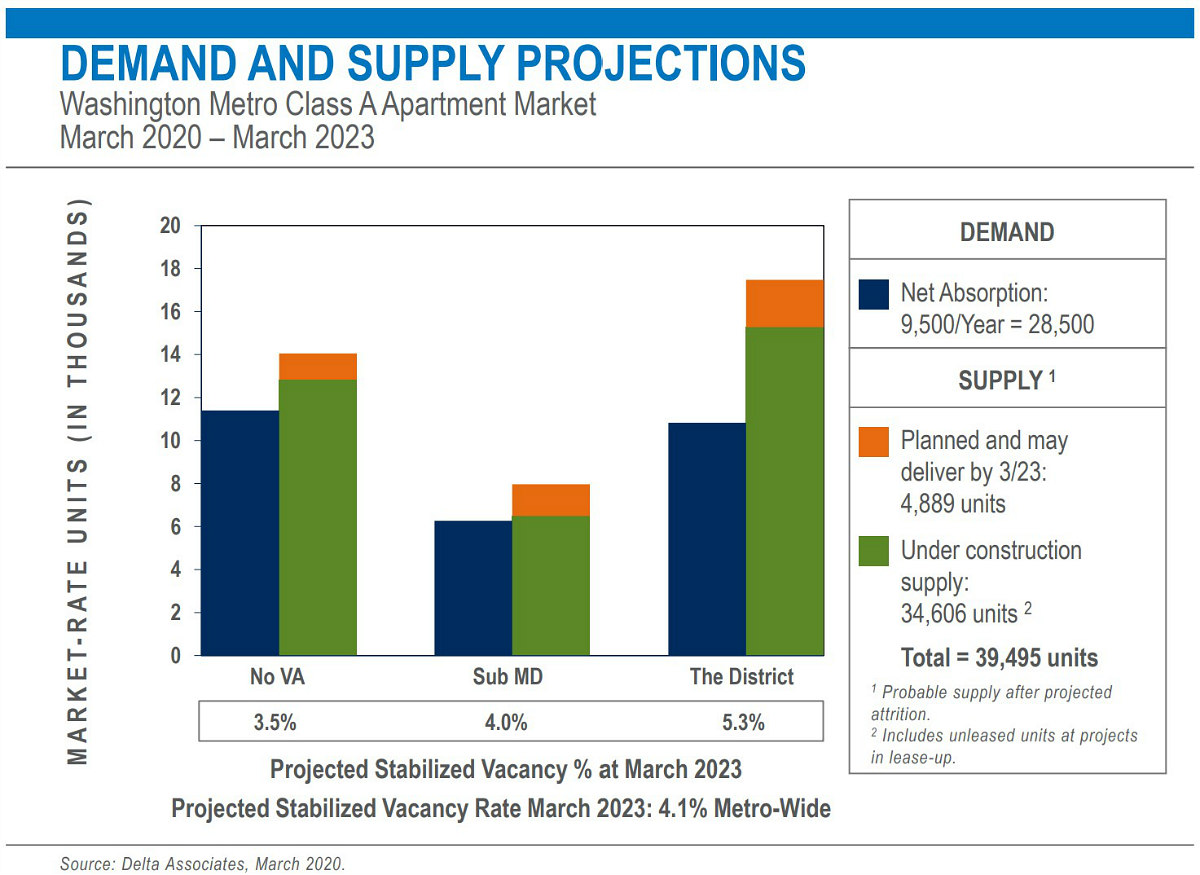

The latest Delta Associates Class A apartment report for the DC region offers perhaps the last snapshot of the metrowide rental market pre-COVID-19.

Although the economy screeched to a halt last month, first-quarter data does not capture the full impact of the current public health emergency. With that in mind, rents for Class A apartments went up by nearly 3% metrowide. Similarly, the metrowide vacancy rate was 3.6% in the first quarter.

There was little discernable disruption in the development pipeline, particularly because construction is still deemed "essential business". In the first quarter, ten projects with 2,808 units broke ground in the immediate area, and nearly 14,000 units were expected to deliver between now and March 2021.

story continues below

loading...story continues above

However, those numbers may be impacted by the end of the second quarter.

"Commercial Real Estate in the region has been moderately affected by the pandemic, although much of the industry is in a wait-and-see pattern, particularly office tenants in lease negotiations or developers that had groundbreakings scheduled for late spring/summer," the report explains.

Going forward, stay-at-home orders and eviction moratoriums imply that occupancy won't take a hit in the short-term, but demand will drop.

This means a drop-off in apartment absorption, which had risen by 12% year-over-year for DC proper, and by an eye-popping 118% in northern Virginia where deliveries had almost quadrupled. Buildings in lease-up are expected to see less absorption than expected, and rent growth will likely slow for at least the next two quarters.

The report offers this local example:

"One operator reported a significant week-over-week slowdown in mid-March, including a 68% decrease in walk-ins (prior to closing offices to the public), a 32% drop in phone call leads, email leads down by 23%, a 54% decline in tours, and applications down 43%."

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,232 per month

- Bethesda: $2,798 per month

- Capitol Hill/Capitol Riverfront: $2,741 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,975 per month

- Columbia Heights/Shaw: $2,698 per month

- Crystal City/Pentagon City: $2,543 per month

- NoMa/H Street: $2,427 per month

- Northeast: $2,208 per month

- Rosslyn-Ballston Corridor: $2,562 per month

- Silver Spring/Wheaton: $1,987 per month

- Upper Northwest: $2,861 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: absorption rate, class a apartments, delta associates, pandemic, stay-at-home, supply and demand

This article originally published at https://dc.urbanturf.com/articles/blog/although-class-a-apartment-absorption-up-in-q1-covid-is-depressing-demand/16750.

Most Popular... This Week • Last 30 Days • Ever

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A report out today finds early signs that the spring could be a busy market.... read »

A potential collapse on 14th Street; Zuckerberg pays big in Florida; and how the mark... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro