$600 Monthly Savings: How DC Homeowners Are Getting in on the Refinancing Bonanza

$600 Monthly Savings: How DC Homeowners Are Getting in on the Refinancing Bonanza

✉️ Want to forward this article? Click here.

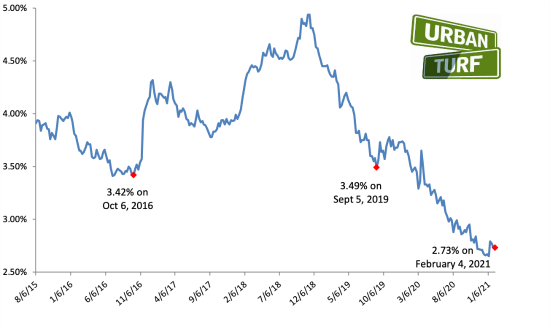

Evidence abounds that mortgage rates hovering near record lows for the past year has kept homebuying demand strong throughout the country. But a surge in refinancing may have outpaced purchase applications, and many DC homeowners are taking advantage of rates that they may not see again.

One such homeowner is Topher Mathews. Mathews, author of the Georgetown Metropolitan blog, found a lender online that extended an offer that would have dropped his 3.375% rate on a 30-year mortgage to around 2.5%. But an offer to pay for discount points on the new mortgage was compelling enough to take advantage of, thus dropping the rate even further.

story continues below

loading...story continues above

"Normally that doesn't really make sense because you often don't really save money over the course of the new loan," Mathews told UrbanTurf in regards to the discount points. "But for whatever reason the pricing on this made sense, so we went for a 2 1/4% rate."

With the refinancing and $8,000 discount point payment, Mathews is saving $600 a month on principal and interest and will save more than $100,000 in interest over the life of the loan, despite adding four years to the term.

Refinancing can also save homeowners time on their new mortgage term if they opt to continue paying the old monthly amount. Borrowers apply the difference between the old and new payment specifically to principal, conceivably taking years off the new mortgage term.

One UrbanTurf reader is just doing that.

Five years into a 30-year mortgage, the reader (who wished to remain anonymous due to the financial details revealed), refinanced in 2020 from a 3.875% interest rate to a 2.75% rate on a $765,000 loan. Her monthly payment, including taxes and insurance, went from approximately $5,500 a month down to $4,100 a month. However, she is going to continue paying the old monthly payment as long as she can, putting the extra $1,400 directly towards principal. If she is able to keep this up for the duration of the loan, she will shorten the new loan term by 13 years.

"If money gets tight I can always drop it down to the new loan payment," the reader said. "But right now, I look at it like I have a 17-year mortgage not a 30-year mortgage."

See other articles related to: interest rates, mortage refinance, refinancing

This article originally published at https://dc.urbanturf.com/articles/blog/600-monthly-savings-how-dc-homeowners-are-getting-in-on-the-refinance-bonan/17849.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro