What's Hot: What Is In The Big New Housing Bill?

5 Predictions For the Spring Market

5 Predictions For the Spring Market

✉️ Want to forward this article? Click here.

As spring approaches, there are a number of questions floating around about the DC area housing market. Will the tight inventory in the for-sale market continue? Will the slew of new apartments entering the rental market push rents down? Will interest rates continue to rise?

With these questions in mind, we asked five local industry professionals to offer their thoughts about the climate of the coming season’s housing market. Following are their predictions. (Click each to skip ahead.)

- As Inventory Stays Low, Buyers Will Try New Tactics

- Supply = Low. Demand = High. Sellers = Happy.

- Apartment Rents Will Fall As New Supply Hits the Market

- Long-Term Rates Could Hit 4.4 Percent By End of Year

- Larger Condo Projects Delivering With First-Timers in Mind

As Inventory Stays Low, Buyers Will Try New Tactics

By Kevin McDuffie, Vice President at Coldwell Banker Residential Brokerage

It is no secret that the low inventory of homes for sale in the DC area market has been making for a very competitive buyer’s market in recent months. Almost all well-priced homes are attracting multiple offers and buyers in the $300,000 to $400,000 range are realizing that they are frequently competing against investors who can outbid them. In order to make their offers more attractive, many buyers are also eliminating the inspection and appraisal contingencies that are standard aspects of a sales transaction. I expect that even as inventory increases, these aforementioned trends will continue into the spring.

However, I also expect buyers to get creative. We are recommending that frustrated home consumers, in all price ranges, try a new approach — go slightly above their price range to look at attractive homes that have been on the market for 60 days or more. The idea is that these homes are overpriced and as such, the seller is likely to be more receptive to an offer below list price. Also, chances are that the contingencies that are so often eliminated in multiple offer situations can be kept in when the buyer is dealing solely with the seller.

Supply = Low. Demand = High. Sellers = Happy.

By Jonathan Hill, President of RealEstate Business Intelligence

Local real estate watchers are already well aware, but statistics are pointing to this being a very attractive spring for tentative home sellers to jump into the market.

Here are few of the metrics that are making it such a good time to sell:

- The median days-on-market for active listings was 24 days in February, which is historically the slowest month of the year, cutting the February 2012 level (53 days) in half.

- The average sales-to-original-list-price ratio in February was 97.1%, the highest since June 2006.

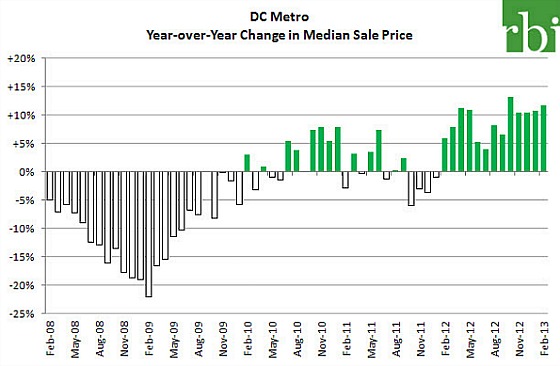

- The median sale price for the area has seen five consecutive months of year-over-year double-digit gains.

And then there is the low inventory.

The number of distressed listings (short sale or foreclosure) are down an average of 31% over the past twelve months versus the previous year, which certainly plays into lower inventory levels. As prices recover, we expect this trend to continue (sorry bargain-hunters!). That said, we’ve seen a modest uptick in the number of new, non-distressed listings compared to years past. For the past 7 months, new non-distressed listings have seen year-over-year increases, evidence that more homeowners are becoming aware of the favorable state of the market.

Now, the sequester could stall this momentum in listing activity, but it also could spur sellers to list (and get in front of the big, still-unknown impacts lurking behind the federal axe). Either way, if listings continue to trickle along or begin to pick up steam, we anticipate the spring market will continue the trends of the past several months with modest price gains, shorter days on market and happy sellers.

Apartment Rents Will Fall As New Supply Hits the Market

By Gregory H. Leisch, CRE Founder and Chief Executive of Delta Associates

The commercial real estate cycle continues to move in favor of the renter, as the delivery of new apartment projects continues to outpace renter demand in the DC area.

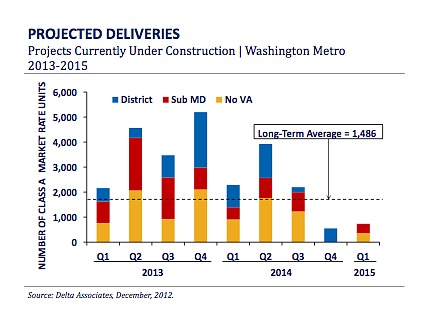

We estimate that 15,000 units will deliver in the region in 2013, 2.5 times the 5,500 apartments that the market needs in a given year. The delivery schedule will peak in the late fall and that is when rental demand tends to level off.

While rents will stay firm in stronger submarkets, they will decrease upwards of 4 percent in certain sub-markets, and even more in those where they are burdened with high levels of new supply.

In addition to rents continuing to soften, tenants can also expect concessions at buildings around the area to increase.

Long-Term Rates Could Hit 4.4 Percent By End of Year

By Kevin Connelly, Vice President of Branch Banking & Trust

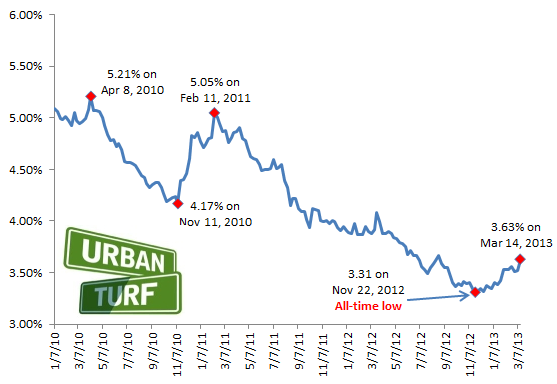

After years of decreasing mortgage rates, the recent trend is indicating that rates have indeed bottomed out, and are now on the rise. The average 30-year fixed rate is now approaching 3.75%, up 0.375% from its low point in late-2012. The long-term rate is expected to remain below 4 percent through the first half of the year, but a gradual increase may result in 30-year rates reaching 4.4% by year’s end, according to the Mortgage Bankers Association (MBA).

The uncertainty created by sequestration and the recent rally in the stock market have counteracted the Federal Reserve’s ongoing stimulus policy attempting to keep rates low. This policy, “Quantitative Easing” or QE, involves the Fed’s active participation in purchasing mortgage bonds in the secondary market to artificially hold long term rates down. Eventually it will cease its bond buying spree and the fear is that rates will jump in reaction.

In short, higher rates and more stringent underwriting guidelines are on the horizon.

Larger Condo Projects Delivering With First-Timers in Mind

By Lynn Hackney, President at Urban Pace

While the majority of new for-sale projects set to deliver in the DC area in the near future are 50 units or less, Urban Pace is starting to see a few larger buildings on the horizon between 80 and 120 units. This represents a strong belief in a robust sales market over the next few years coupled with extremely low supply overall. Developers are seeing many alternatives with equity and debt financing for these larger deal sizes, which is a game changer over just 12 months ago.

Most of the buildings moving forward remain in the first-time buyer price group with price points ranging from the low $300,000s to high $500,000s. This would include primarily one-bedrooms with one-and-dens and two-bedrooms on the upper end of the price range.

See other articles related to: editors choice, spring market predictions

This article originally published at https://dc.urbanturf.com/articles/blog/5_predictions_for_the_spring_market/6781.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro