3.98: Mortgage Rates Jump Back Up; New Home Sales Fall

3.98: Mortgage Rates Jump Back Up; New Home Sales Fall

✉️ Want to forward this article? Click here.

After three straight weeks of record setting lows, mortgage rates jumped back up today.

This morning, Freddie Mac reported 3.98 percent with an average 0.7 point as the average on a 30-year fixed mortgage. Rates hit a record low of 3.88 percent last week and have been below 4 percent now for eight consecutive weeks.

From Freddie Mac vice president and chief economist Frank Nothaft:

Fixed mortgage rates ticked up this week as the housing market ended 2011 on a high note. New construction of one-family homes rose 4.4 percent in December to an annualized rate of 470,000, the most since April 2010. Existing home sales increased 5.0 percent at the end of the year to 4.61 million houses, the largest amount since May 2010.

At the same time that the rates were announced, not-so-good news came from the Commerce Department, which reported that new home sales fell unexpectedly in December by 2.2 percent. Sales were at an annual rate of 307,000, below the 325,000 number that economists had expected.

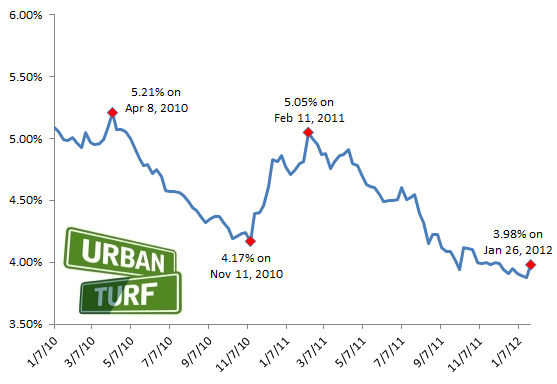

Here’s a look at the path of rates since last January:

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/3.98_mortgage_rates_jump_back_up/5000.

Most Popular... This Week • Last 30 Days • Ever

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro