What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

$110 a Month: The Difference a Year Makes in Interest Rates

$110 a Month: The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

For the third week in a row, mortgage rates have settled at 4.10 percent, their lowest level in a year. One year ago, the average interest rate on a 30-year fixed-rate mortgage was 4.57 percent. On Thursday morning, Freddie Mac reported 4.10 percent as the average on the same type of loan. That .47 difference in rates impacts your mortgage payments more than you might think.

Using the example of a home buyer with excellent credit purchasing a $500,000 home, UrbanTurf examined how monthly mortgage payments changed between this year and last. In each case, we assumed the buyer put down a 20 percent down payment. These figures refer just to the principal and interest on a loan, and don’t take into account taxes or insurance.

Here are the two scenarios:

September 2013: The average mortgage rate was 4.57 percent.

Monthly mortgage payment: $2,043

Total outlay on mortgage (monthly payment x 360 months): $735,480

September 2014: The average mortgage rate is 4.10 percent.

Monthly mortgage payment: $1,933

Total outlay on mortgage (monthly payment x 360 months): $695,880

So, the difference between a rate of 4.57 percent and 4.10 percent is about $110 a month, or $39,600 over the life of the loan.

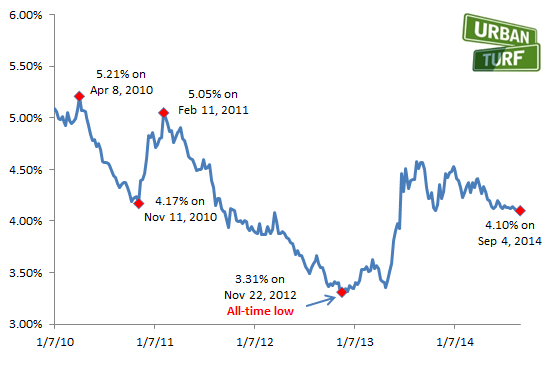

Here’s a look at the path of the rates over time:

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: mortgage rates, the difference a year makes

This article originally published at https://dc.urbanturf.com/articles/blog/110_a_month_the_difference_a_year_makes_in_interest_rates/8931.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro