What's Hot: Barnes and Noble Will Return to Georgetown in June | The 3,000 Units On The Boards From Trinidad to Gallaudet

DC Area Has Too Many Apartments, Too Few Condos, Report Says

DC Area Has Too Many Apartments, Too Few Condos, Report Says

A rendering of a 40-unit condo project planned near the U Street Corridor.

There still aren’t enough condos being built to meet demand in the DC region, mostly because financing for such projects hasn’t fully rebounded since the housing crisis, according to a new report. The Delta Associates report released Wednesday also found that the oversupply of apartments and an undersupply of condos can’t be fixed by converting rentals into condos.

“With less than 10 months of supply, there are simply too few new units available in the market,” the report concluded. (In many parts of DC proper, the supply is less than six months, Delta’s William Rice tells UrbanTurf.) Delta goes on to say that developers are attributing the shortage to “construction financing and end-loan financing obstacles.” The problem will take time to fix, because condo conversions aren’t likely for most of the apartment buildings coming onto the market this year.

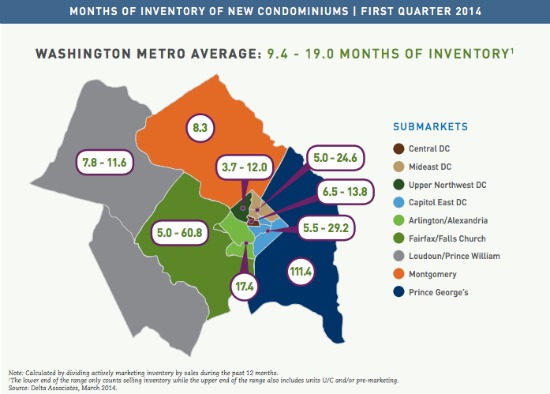

A chart showing the months of inventory available in DC-area markets.

From Delta:

“…financial markets are hampering condo conversions of larger properties as an overreaction to the credit crunch in the latter part of the last decade. We count only 1,662 rental apartment units that would make sensible candidates to convert to condo – not enough to help either an overbuilt apartment market or under-served condo market. As a result, condo supply remains tight and will remain tight in the metro area for the foreseeable future.”

Here are some other key findings:

- The area had its strongest annual new condo price increase since 2005. Prices rose by 6.7 percent for the year ending in March 2014, that measure’s strongest showing since 2005.

- New condo sales went down in the first quarter of 2014, with 376 sales in the DC area, but sales volume is up 26 percent in the central and eastern sections of DC, which the report called “a testament to the shift in market trends to urban living.”

- The condo market shifts depending on where you’re looking. New condo sales activity is highest in Prince William and Loudoun counties, followed by Arlington and Alexandria. In suburban Maryland, Montgomery County has the highest sales activity, while in DC, the mideast region has the most activity.

- There is some relief coming for the new condo market. By the end of the year, more than 2,000 new units should be under construction, and the number of units planning to begin sales in the next three years — 2,730 — is at the highest level since 2011.

See other articles related to: condo supply, condos, dclofts, delta associates, new construction

This article originally published at https://dc.urbanturf.com/articles/blog/dc_has_too_many_apartments_and_too_few_condos_report_says/8314.

Most Popular... This Week • Last 30 Days • Ever

Rossdhu Gate is the remaining piece of a 30-room castle built by socialite Daisy Calh... read »

A Home Equity Line of Credit, commonly referred to as HELOC, is a borrowing product t... read »

Georgetown Metropolitan reported on Tuesday that the Instagram account for the nation... read »

The Gen Z market; ranking food halls around DC; and is this the new king of Queens?... read »

The term "luxury" has been applied broadly in the housing market, but a new report ai... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro