What's Hot: 1 in 4 Home Sales in DC This Year Has Been All Cash | Georgetown Condo Closes For $5.3 Million

Another Look at Renting Out Foreclosures

Another Look at Renting Out Foreclosures

✉️ Want to forward this article? Click here.

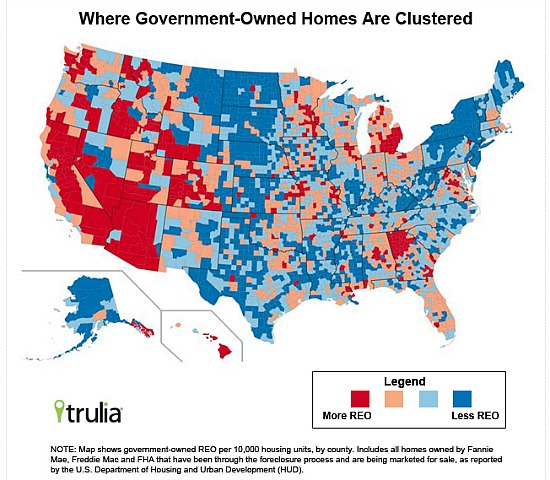

Back in the middle of the summer, the concept that the government should try to fill foreclosed homes with renters was floated. Yesterday, the Trulia Insights blog looked at the effectiveness of a push by Fannie, Freddie and the FHA to sell government-owned homes to investors who would then fill them with tenants.

Trulia’s Chief Economist Jed Kolko explored the impacts of the policy, analyzing the market for REO homes and determined that while the policy is a small step in a positive direction and would help some distressed neighborhoods, with REO homes clustered in places like Michigan, Georgia, the Southwest, and inland California, most urban centers wouldn’t see too much benefit.

From Kolko:

If you don’t live in a neighborhood with lots of homes that the government can sell or rent, then REO policies wouldn’t do you much good. Renting out these government-owned homes wouldn’t ease pressure on tightening urban rental markets. Renters typically live in bigger, denser cities, which are not where most of the government-owned homes are. In fact the typical location of a government-owned home is in a neighborhood with fewer renters, higher rental vacancies and where homes are more spread out.

See other articles related to: renting out foreclosures, reo properties, trulia

This article originally published at https://dc.urbanturf.com/articles/blog/another_look_at_renting_out_foreclosures/4674.

Most Popular... This Week • Last 30 Days • Ever

A Roth IRA is one of those accounts that people feel is totally off limits until you ... read »

The property tax hike will be on homes in the city valued at more than $2.5 million.... read »

Today, UrbanTurf catches up with what's in the works in terms of residential developm... read »

This week's Best New Listings includes a one-story Falls Church mid-century modern, a... read »

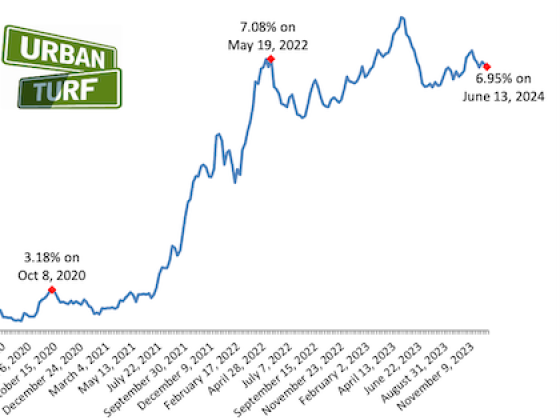

Freddie Mac reported 6.95% as the average on a 30-year mortgage on Thursday, down 4 b... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro