What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

83% of DC Homes Have Passed Their Pre-Recession Peak Value

83% of DC Homes Have Passed Their Pre-Recession Peak Value

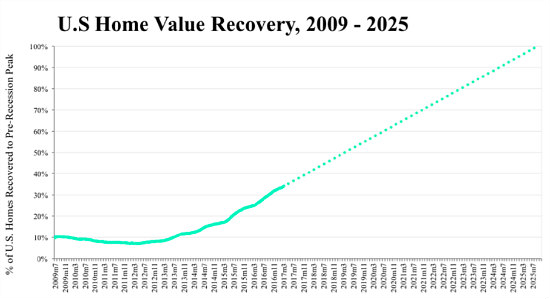

Actual and projected home value recovery

During the eight years since the national housing crisis, home prices in the District have been steadily rising. Now a new report reveals that home values in the city have surpassed their pre-crisis peaks.

According to the report by Trulia, 83 percent of homes in DC proper have surpassed their pre-recession values. In the DC area, however, it’s a different story: only 19.5 percent of homes have recovered to their pre-recession peak value of $437,217, with median peak values at $381,913 today.

story continues below

loading...story continues above

Nationwide, 34.2 percent of homes have seen their value exceed the pre-recession peak. When examining the 100 largest metropolitan areas across the country, housing value recovery ranges from as low as 0.6 and 2.4 percent respectively in Las Vegas and Tucson to as high as 98.7 and 98 percent respectively in Denver and San Francisco.

The sluggish recovery of home values in some markets has a lot to do with the foreclosure crisis that accompanied and outlasted the recession, leaving the share of homes that recovered their value at a low of 7 percent in April 2012. Since that time, recovery has held steady at roughly 5 to 6 percent annually, making 100 percent recovery unlikely until September 2025.

Unsurprisingly, income growth strongly correlated to the recovery of home values, with housing markets that saw the most robust income growth between December 2009 and January 2017 seeing a greater share of homes surpassing pre-recession peak values.

See other articles related to: dc area market trends, dc home prices, home values, trulia, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/83_of_dc_homes_have_passed_their_pre-recession_peak_value/12523.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

- What Are the Annual Maintenance Costs When You Own a Home?

- A First Look At The New Plans For Adams Morgan's SunTrust Plaza

- 46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

- How Much Did DC-Area Rents Rise At The Beginning of 2024?

- The 4 Projects In The Works Near DC's Starburst Intersection

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro