What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

How Much Do You Need to Make to Afford DC's Rent?

How Much Do You Need to Make to Afford DC's Rent?

Two new studies show just how difficult it is to afford the rent in DC, especially on a modest income.

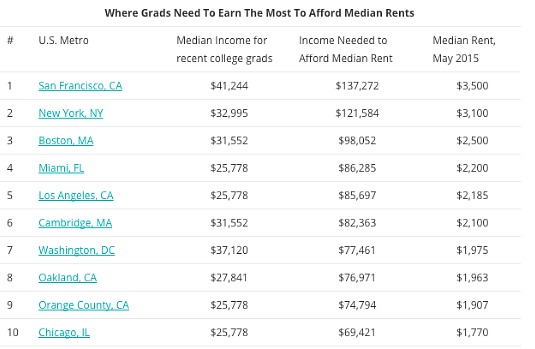

Trulia looked at rental markets from the perspective of a recent graduate, comparing the median income for that group with the median rent in major cities. A more robust study from the National Low Income Housing Coalition (NLIHC) looked at how much a family would need to make to keep rental costs at 30 percent of income and afford rent and utilities at a unit renting at “Fair Market Rent,“ defined by the Department of Housing and Urban Development. Fair market rents refer to modest accommodations.

story continues below

loading...story continues above

Topping the list of unaffordability in both studies was San Francisco, where a graduate would need to make $137,272 a year to afford the median rent of $3,500 a month. A household would have to earn about $40 an hour to afford the fair market rent of $2,062 a month for a two-bedroom in San Francisco.

And there’s no state in the country where a person earning the state or federal minimum wage can afford a one-bedroom apartment, the NLIHC study found.

In both studies, DC ranked as one of the most unaffordable places to live. The Trulia study found the median wage for recent grads, $37,120, wasn’t nearly enough to afford the median rent of $1,975. To afford that grads would need to be making $77,461 a year.

And to afford a two-bedroom at fair market rent in DC — $1,458 a month for a two-bedroom — a household would need to be making $28.04/hour.

See other articles related to: minimum wage, rent affordability, trulia

This article originally published at https://dc.urbanturf.com/articles/blog/how_much_do_you_need_to_make_to_afford_dcs_rent/9909.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

A new hotel has been pitched for a development site in Mount Vernon Triangle that has... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro