As The Market Cools, Homebuyers Finally Take a Breath

As The Market Cools, Homebuyers Finally Take a Breath

✉️ Want to forward this article? Click here.

Like many househunters in the DC region, Liz Mandle's clients had been running into stiff competition as they searched for a home. First, they were one of six offers competing on a listing in Virginia and lost. Next, they went up against seven offers on another Virginia home and were also unsuccessful.

Then, as interest rates began to rise, their purchasing power fell about $100,000 below their $1 million budget. After that, a curious thing happened: they went under contract on a home.

"We were unsuccessful against six and eight offers, but won recently when we were up against only one other buyer," Mandle of Compass told UrbanTurf.

This anecdote is one of several that UrbanTurf has heard recently which point to the DC housing market doing something that it hasn't done in years: slowing down.

As interest rates rise, home prices remain high and inventory creeps back up, homebuyers are either slowing down their search or finding that the climate of feverish competition and no-contingency offers may be a thing of the past.

"A healthy housing market is a market where a buyer has time to make a decision," Bright MLS economist Lisa Sturtevant told UrbanTurf. "We are moving back towards a market like that."

Sturtevant pointed out that showings fell in the DC area in recent months, inventory is back to mid-2020 levels, and home sales are down from the feverish pace of last spring, an indication that buyers may be pulling back.

Max Rabin, an agent with TTR Sotheby's International Realty, is working with an overseas client who recently emailed saying that they are going to hold off on looking at properties for the time being.

"We haven’t had too long of a time to figure out what the overall effect of this interest rate environment is, but I have had some new buyers put the brakes on," Rabin told UrbanTurf. "There have definitely been some price reductions in recent weeks and working with buyers, I haven’t run into as many heated multiple offer situations."

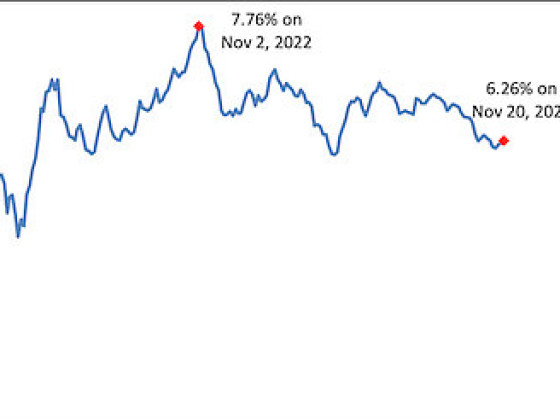

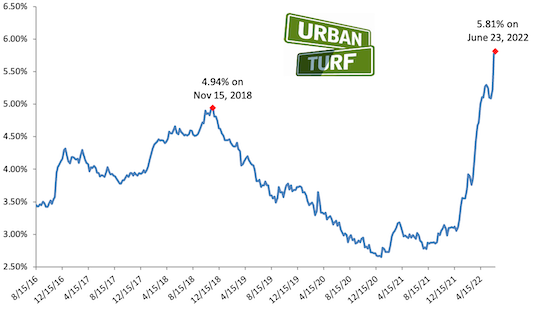

While many factors could be at play for the changing climate of the market, it is hard not to point to interest rates as the factor in most buyers' calculus. The average 30-year interest rate has risen nearly two full percentage points since March.

"Think about going to the store and buying something that is 42% more expensive than what it was last week," Sturtevant said. "That is what buyers are faced with right now."

As demand falls, price appreciation should follow suit. Sturtevant recently said that she expects price appreciation to be more in the 2%-5% increase going forward, as compared to the double-digit increases that have become common in the region.

While all these signs point to the market pendulum swinging notably back in favor of buyers, expectations should probably be tempered.

"Even with rising mortgage rates, it will still remain decidedly a seller’s market as inventory will remain very low," Sturtevant explained. "Existing homeowners are not rushing out to sell because many have refinanced and have a low mortgage rate. New construction still remains far below what is needed to meet demand. So while the buyer pool will contract, there will still be relatively few homes to choose from. Instead of 5 or 6 buyers competing for each home, there may just be 2 or 3."

See other articles related to: dc area home prices, dc area housing market, dc area housing supply, dc area market trends, dc housing market

This article originally published at https://dc.urbanturf.com/articles/blog/as-the-market-cools-homebuyers-finally-take-a-breath/19801.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro