What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

Will Rates Fall Below 3 Percent?

Will Rates Fall Below 3 Percent?

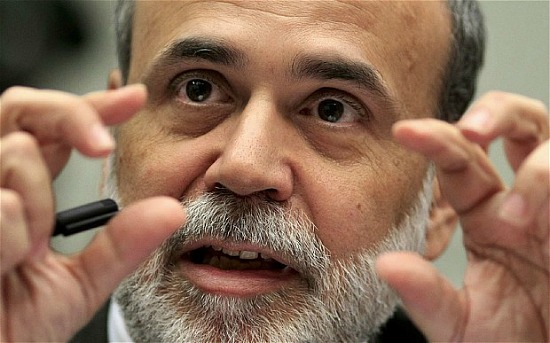

Fed chairmen and QE3 architect Ben Bernanke. Photo courtesy AP.

Last week, we reported that the average on a 30-year fixed-rate mortgage reached a new low of 3.40 percent. Will QE3 eventually pull them below 3 percent?

QE3, the popular shorthand for the third iteration of Quantitative Easing, is basically the Federal Reserve’s attempt at jump starting the economy. By buying up $40 billion in mortgage-backed securities every month, the Fed is hoping that banks will feel comfortable offering more loans, consumers will seek out more loans, and the economy will generally start moving more robustly.

Our big question is how exactly QE3 will impact mortgage rates and the housing market. Will rates drop below 3 percent? Rates are already at historic lows; how long will they stay there? What are the implications of low rates?

To gain some insight into these questions, UrbanTurf reached out to a few real estate experts, from lenders to economists. Check out their thoughts below.

John Settles, Branch Manager and mortgage consultant, Wells Fargo

QE3 alone won’t [push rates under 3 percent]. However, the fiscal cliff and/or falling back into recession, or a sovereign default in Europe aiding QE3 will push rates under 3 percent. As for how long they will remain low, they will be under 4 percent for one year, max two.

Jonathan Miller, President, Real Estate Appraisal and Consulting Firm Miller Samuel

The simple answer [to the question of how long rates will remain at historic lows] is, “who knows?” since few, if any, thought we’d be seeing record lows in mortgage rates now. However, I’d guess that QE3 won’t push mortgage rates much lower. Mortgage lenders already pared back on staffing to handle mortgage processing and are unlikely to rehire to expand capacity, so it’s unlikely that they would feel much of an incentive to press rates lower. In fact, low mortgage rates are keeping credit standards as high as they have ever been in decades. I think they will be more interested in enjoying the spread [the difference between the rates at which they borrow and re-lend to consumers] by keeping rates close to where they were before QE3 as their cost of borrowing drops.

I can’t imagine rates going down more than another 0.25 point [to 3.15 percent], but of course that was the common refrain a few years ago. I’m hoping this flawed strategy ends soon so we can deal with reality. The longer the housing market is built around artificially low mortgage rates, the longer and more difficult it will be to ween consumers off of them. A housing recovery is dependent on easing of credit standards to more historic normal levels (but not the nonexistent standards of the prior decade). Low rate policy by the Fed is telegraphing to the banks that they expect more problems ahead, and that makes lenders more firm in their resolve to keep credit standards tight.

Jed Kolko, Chief Economist, Trulia

The Fed’s plan to buy mortgage-backed securities in order to push interest rates – and especially mortgage rates – lower is likely to:

- Have a moderate effect on refinancing. The decision to refinance depends on the gap between the current market rate and the rate a homeowner is already paying. Lower mortgage rates will encourage some homeowners to refinance. However, rates have been low and dropping for years, so many people have already refinanced and might not find it worth it to refinance again.

- Have little effect on home-buying. The decision to buy depends on many factors. Lower mortgage rates make homeownership cheaper – and today’s low rates are a big reason why buying is 45 percent cheaper than renting nationally. But the main obstacles to homeownership today are saving enough for a down-payment and qualifying for a mortgage under today’s high credit standards. Lower mortgage rates alone won’t lead to lots of new home-buying.

- Have almost no effect on foreclosures. The overhang of foreclosed homes remains a problem for the housing market. Lower mortgage rates do not make borrowers better able to pay their mortgage and avoid foreclosure unless they can refinance – and most refinancing programs require borrowers to be current on their payments. People on the verge of losing their homes won’t benefit.

Overall, the main effect is to encourage some refinancing. Refinancing helps stimulate the economy because homeowners who refinance get a lower monthly mortgage payment and therefore have more money left over to spend on other things. Lower interest rates (aside from mortgage rates) will provide general economic stimulus, as well, which should help housing demand, so QE3 will give the housing market some indirect help, too.

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/will_rates_fall_below_3_percent/6101.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

A new hotel has been pitched for a development site in Mount Vernon Triangle that has... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro