Points and Low Interest Rates: A Primer

Points and Low Interest Rates: A Primer

✉️ Want to forward this article? Click here.

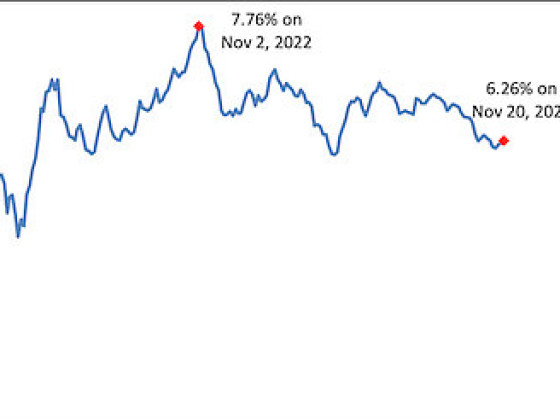

Last Thursday, long-term interest rates reached historic lows for the second week in a row. However, as UrbanTurf has written in previous posts, the rates announced by Freddie Mac each week are not quite as good as advertised, as they usually carry points with them.

Points are essentially a form of pre-paid interest on a loan. When Freddie Mac issues its mortgage rates each week, the published average usually includes an average “point” that the lender will charge. That point translates into a percentage of the total loan that the borrower must pay up front in order to get the latest interest rate. For example, if a borrower is looking to get a $300,000 home loan and mortgage rates are at 4.2 percent, with 0.8 of a point as the average, that means that they will have to pay 0.8 percent of the total loan amount ($2,400) up front to get the quoted rate. (Of course, a variety of other factors — credit score, down payment amount — also play into getting the lowest rate available.)

Conventional wisdom is that it takes somewhere in the 5 to 7 year range to recoup the point that you would pay upfront on a loan, which is good for buyers to keep in mind when they are envisioning how long they will live in the property they are purchasing. For example, say that you want to take out a $400,000 home loan and you have the option of a 30-year fixed-rate mortgage at 4.3 percent with no points or 4.09 percent with 0.8 of a point. Monthly payments on the first option would be $1,979. After an upfront payment of $3,200, payments on the second loan would be $1,930. The time it would take to make up the difference between the two loans is 65 months or about 5.5 years.

In today’s mortgage market, however, it is not out of the question to find a great rate on a conventional loan that does not carry any points. A borrower just usually needs to have a very good credit history and be able to put 20 percent down.

UrbanTurf gave BB&T’s Matt Rexrode a hypothetical borrower with a credit score of 750 and 20 percent to put towards a down payment to see how low a rate the person would qualify for. Presently, that person can qualify for a 30-year mortgage at a 4 percent with no points through BB&T. (This was late last week, so that rate may have changed since then.)

For more on mortgage points, particularly as they relate to taxes, click here.

See other articles related to: bb&t, freddie mac, interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/points_and_low_interest_rates_a_primer/4148.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro