What's Hot: Nicklas Backstrom's $12 Million McLean Home Finds A Buyer | HPO Recommends Approval Of Georgetown Conversion

DC Area Rents Drop 3% As New Apartment Supply Rises

DC Area Rents Drop 3% As New Apartment Supply Rises

✉️ Want to forward this article? Click here.

The Shay, a 245-unit apartment project planned in DC.

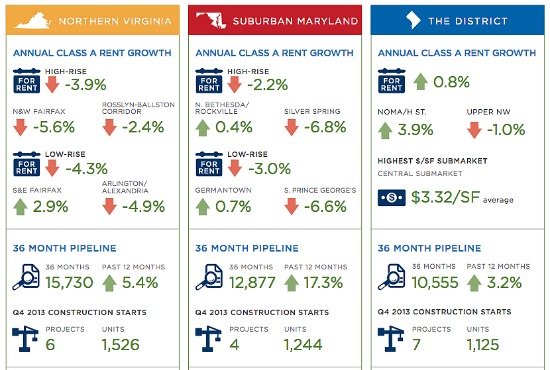

A report out today from Delta Associates analyzing the regional apartment market in the fourth quarter of 2013 reveals that rents for Class A apartments (large buildings built after 1991, with full amenity packages) in the DC area dropped 3 percent last year, a clear sign that the supply of new apartments is catching up to demand in the area.

Class A rents fell year-over-year by about a percentage point in upper NW DC and also dropped in the Rosslyn-Ballston Corridor (-2.4%) and Silver Spring (-6.8%) Rents did not fall everywhere, however. In DC proper, rents actually rose by 0.8 percent despite the large number of new apartments delivering, thanks to a continued high level of demand. In the NoMa/H Street sub-market, rents increased 3.9 percent.

Here is a quick snapshot of average rents for Class A apartments in DC area sub-markets, as defined by Delta:

- Central: (Penn Quarter, Logan Circle, Dupont Circle, etc.) $2,822 a month

- Upper Northwest: $2,648 a month

- Columbia Heights/Shaw: $2,480 a month

- NoMa/H Street: $2,295 a month

- Alexandria: $1,955 a month

- Rosslyn-Ballston: $2,337 a month

- Tysons Corner: $1,746 a month

- Bethesda: $2,580 a month

Note: The rents are an average of studios, one and two-bedroom rental rates at new buildings in the DC area.

There are a number of reasons that rents are now falling, but primarily it is due to high levels of new supply and a pipeline that now seems oversized compared with demand. For loyal UrbanTurf readers this should not come as surprise. In 2012, we reported that the delivery of new apartment projects (and resulting increase in vacancies) will put downward pressure on rents.

Definitions:

- Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

This article originally published at https://dc.urbanturf.com/articles/blog/dc_area_rents_drop_3_as_new_apartment_supply_rises/7979.

Most Popular... This Week • Last 30 Days • Ever

An application extending approval of Friendship Center, a 310-unit development along ... read »

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro