What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Case-Shiller: DC Area Home Prices Show Slight Annual Increase

Case-Shiller: DC Area Home Prices Show Slight Annual Increase

✉️ Want to forward this article? Click here.

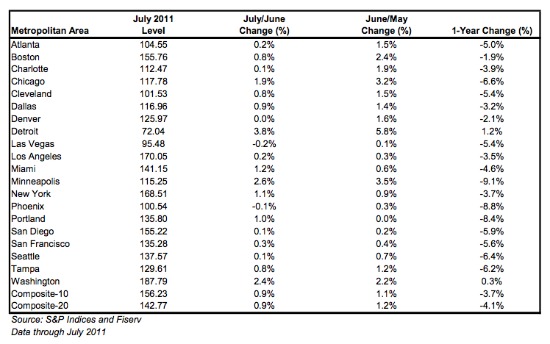

The latest Case-Shiller report released this morning showed that home prices rose about 1 percent nationally between June and July 2011, but that prices dropped across the country by about 4.1 percent since July of last year. The index reported that home prices in the DC area increased on both a monthly (+2.4%) and annual (+0.3%) basis.

Case-Shiller July 2011

Between June 2011 and July 2011, area prices increased in each price tier measured by the index: the low tier (homes under $293,756), the middle tier (homes between $293,756 and $457,827) and the high tier (homes above $457,827). The most notable increase between June and July came in the low tier. DC and Detroit were the only two cities in the 20-city index that showed year-over-year home price increases.

From David M. Blitzer, Chairman of the Index Committee at S&P Indices:

“While we have now seen four consecutive months of generally increasing prices, we do know that we are still far from a sustained recovery. Eighteen of the 20 cities and both Composites are showing that home prices are still below where they were a year ago. The 10-City Composite is down 3.7% and the 20-City is down 4.1% compared to July 2010. Continued increases in home prices through the end of the year and better annual results must materialize before we can confirm a housing market recovery.”

When considering the Case-Shiller findings, recall that the index is based on closed sales and home price data from 5 to 7 months ago. Another thing that is important to note is that the main index only covers single-family home prices, so co-op and condo prices are not included in the analysis that is widely reported. This means that in places like DC, Chicago and New York City where condos/co-ops are prevalent, the index does not offer the most accurate picture of housing prices.

See other articles related to: case-shiller, dc home and condo prices, home prices, home values

This article originally published at https://dc.urbanturf.com/articles/blog/case-shiller_dc_area_home_prices_show_slight_annual_increase/4233.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro