DC Area's Middle Class Can Afford Homes $441,000 and Under

DC Area's Middle Class Can Afford Homes $441,000 and Under

A new study from Trulia shows that about 62 percent of homes for sale in the DC area are in reach of the middle class.

The study, which uses data from the rather large DC metro area, puts the region’s median middle class income at $88,865 and from there calculates that an affordable home would be priced at $441,000. Of the homes on the market in the area, about 62 percent fall at or below that price point, Trulia reported in the study released Tuesday. If you look at just DC proper, that percentage falls to 44 percent; if you are looking in Prince George’s County, it jumps to 85 percent.

Trulia relied on an affordability calculation that puts the monthly cost of homeownership at 31 percent or less of a household’s monthly income. The total monthly payment for the report includes the mortgage payment assuming a 20 percent down payment. The percentage of available homes to the middle class would be lower if a down payment of lower than 20 percent was used in the calculation.

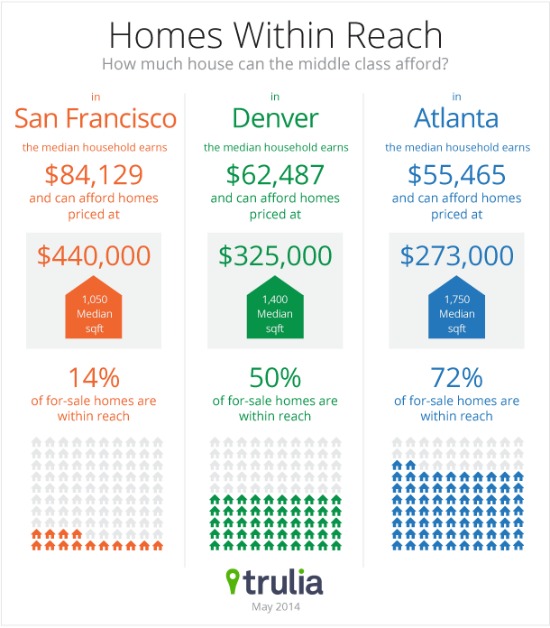

Here are some other takeaways from the nationwide study, which calculated a different measure of “middle class” in each area:

- The majority of homes for sale in most U.S markets are within reach of the middle class.

- Over 80 percent of the homes for sale in Detroit and Cleveland are within reach of the middle class. In San Francisco, just 14 percent of homes for sale are considered affordable to the middle class.

- Of the top 10 least affordable markets in the country, seven are in California.

See other articles related to: affordability, middle class, trulia

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_dc_areas_middle_class_can_afford_homes_441k_and_under/8485.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Today, UrbanTurf is examining one of our favorite metrics regarding competition in th... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

Airbnb's push to build condos; the Virginia town that Gen-X loves; and Ohtani's Hawai... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro