Home Price Watch: A 28 Percent Increase in Woodridge and Langdon

Home Price Watch: A 28 Percent Increase in Woodridge and Langdon

A home currently on the market in 20018.

In Home Price Watch, UrbanTurf analyzes the housing markets in various zip codes around the DC area using numbers provided by RealEstate Business Intelligence (RBI).

This week, we examine 20018, the zip code roughly bordered by the District’s eastern boundary, New York Avenue NE, and a meandering western border that follows the railroad tracks, Franklin Street NE and 16th Street NE. It’s home to portions of Woodridge, Langdon and Brentwood.

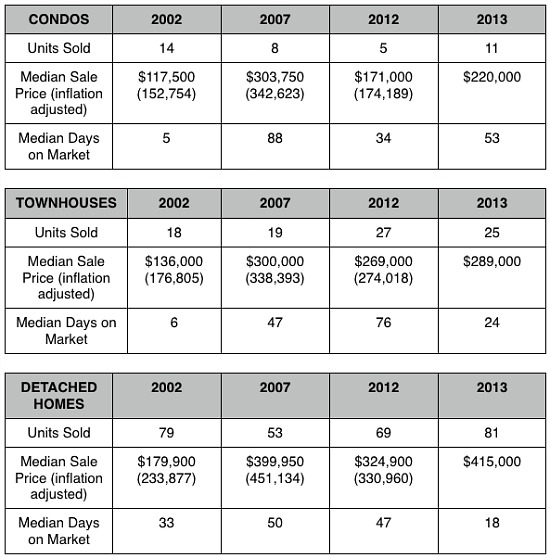

20018 is dominated by detached homes, as we noted last year, and the well-sized suburban-feeling abodes have been increasingly sought after by young families in a city where home prices only seem to get more out of reach. As an area full of family homes, we wondered last year if the relatively high median days-on-market (47) was due to low turnover.

The median sale price has risen substantially in the zip code since last year, from $324,900 to $415,000, a 28 percent increase and approaching 2007’s inflation-adjusted price of $451,134. Properties also came off the market much faster; detached homes found buyers in a median of 18 days, and townhouses went under contract in a median of 24 days. Townhouse and condo prices have also risen slightly since 2012, though they are not yet close to 2007 levels.

For a look at home prices in other zip codes around the region, see below.

Similar Posts:

- Home Price Watch: Steady in Southwest Waterfront

- Home Price Watch: Townhouse Prices Increase By 35 Percent in 20008

- Home Price Watch: 20007—DC’s Toniest Zip Code

- Home Price Watch: Townhomes Break $1 Million in 20009

- Home Price Watch: Rising 15 Percent a Year in Bloomingdale and LeDroit

- Home Price Watch: Climbing on Capitol Hill and Hill East

This article originally published at https://dc.urbanturf.com/articles/blog/home_price_watch_family_homes_climbing_in_price_in_woodridge_and_langdon/7627.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Plans for the development at a prominent DC intersection began nearly eight years ago... read »

The eight-bedroom, 35,000 square-foot home in McLean originally hit the market in 202... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro