Foreclosure Rates Fall in DC Area, Following Trend in Rest of the Country

Foreclosure Rates Fall in DC Area, Following Trend in Rest of the Country

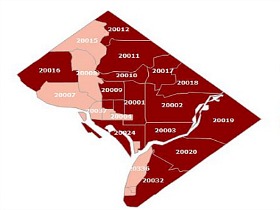

Analytics firm CoreLogic is reporting that loan delinquency and foreclosure rates fell in the DC area in January.

The rate of homeowners in the DC area who were three months or more behind on their mortgage payments dropped to 5.35 percent in January, down from 5.94 percent in January 2012. The percentage of homeowners whose homes were being foreclosed on dropped from 2.37 percent to just above 2 percent during that period.

The trend that the DC area is experiencing is in line with what is going on in the rest of the country. The national delinquency rate (6.34%) and foreclosure rate (2.9%) both dropped in January.

See other articles related to: corelogic

This article originally published at https://dc.urbanturf.com/articles/blog/foreclosure_rates_fall_in_dc_following_trend_in_rest_of_the_country/6832.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

The owner of 700 Monroe Street NE filed a map amendment application with DC's Zoning ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro