DC-Area Renters Pay $8,313 More Annually in Rent Now Than 20 Years Ago

DC-Area Renters Pay $8,313 More Annually in Rent Now Than 20 Years Ago

With housing supply as constrained as it is currently, it may come as a surprise to some that mortgages are more affordable now than they were 20-40 years ago, but a new study from Zillow shows just that.

The new report concludes that U.S. homeowners pay $3,300 less in mortgage costs annually, thanks in large part to low interest rates, than they did in 1985-2000, spending 15.4 percent of their monthly income on a mortgage now vs. 21 percent during the aforementioned 15-year span.

story continues below

loading...story continues above

Conversely, renters now spend $2,000 more annually on rent than during that same span, with the median rent nationwide taking up 29 percent of median monthly income compared to 25.8 percent of income before the turn of the century.

Rent and mortgage affordability in DC

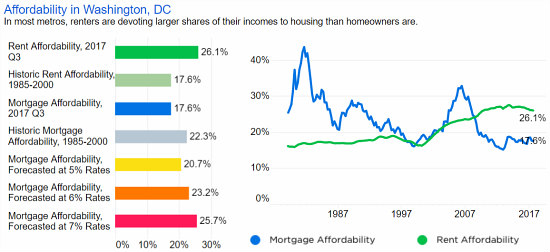

This affordability differential is vastly more pronounced in the District, where renters spend $8,313 more annually on housing than they did historically. Renters in the DC area pay 26.1 percent of their monthly income towards rent, 8.5 percent more than they would have spent in 1985-2000.

The relatively high median income in the region likely has a lot to do with why renters here pay so much more annually than they would have previously, yet pay a smaller share of monthly income on rent than the typical U.S. renter. Zillow’s conclusions are based on housing data from the third quarter of 2017.

Thumbnail images by Ted Eytan.

See other articles related to: affordability, rent affordability, rent vs. buy, renting in dc, renting vs. buying, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/dc-area_renters_pay_8313_more_annually_on_rent_now_than_20_years_ago/13312.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

Plans for the development at a prominent DC intersection began nearly eight years ago... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro