Although Absorption Is High, Class A Apartment Rents Decline in DC

Although Absorption Is High, Class A Apartment Rents Decline in DC

The view from the rooftop at DC’s F1RST apartments.

The decline in rents in DC proper for new Class A apartment buildings foreshadowed earlier this year came to fruition in the third quarter.

A new report from Delta Associates shows that the metropolitan area is continuing to absorb Class A apartments at an above-average rate, having seen the third consecutive quarter of over 10,000 units absorbed. However, the glut of supply is suppressing rent growth, which rose only 0.2 percent year-over-year in the area.

In the District, rents fell by 1.3 percent over that time while absorption rose by 36 percent. Some of the DC submarkets experiencing the greatest absorption are those where much of the development pipeline is concentrated; the Capitol Hill/Riverfront/Southwest area, for example, is experiencing a boom in apartment stock, yet absorption is up 157 percent.

story continues below

loading...story continues above

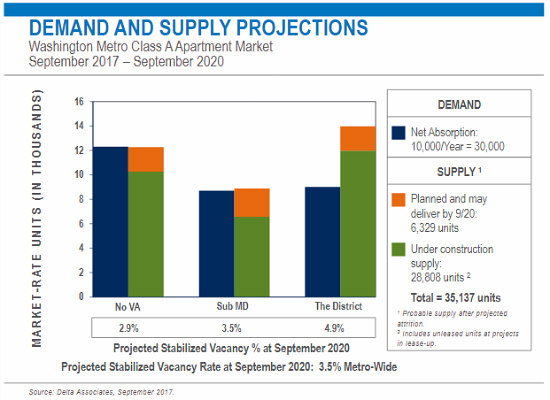

Projected supply and demand in the DC metro area

“What is surprising is the submarkets where most of the new supply has entered the market — Capitol Hill/Riverfront/SW and NoMa/H Street, outperformed the District as a whole,” the report explains. “Vacancy also decreased in these two submarkets, while the city-wide rate increased. This indicates these areas of the city are benefiting from new residents at the expense of some of the more established areas of the District.”

Overall, the development pipeline may have reached its peak, as 11,735 units delivered in the year that ended at the end of September while 12,270 broke ground in the same timeframe. The 36-month development pipeline increased to 35,137 units, with 11,371 of those units delivering in the next 12 months.

In the District in particular, this abundance of supply is outstripping citywide demand, as evidenced by the vacancy rate rising 30 basis points over the past year. It remains to be seen whether the regional market has plateaued.

“We expect regional Class A rent growth to remain below the long-term average over the next three years, increasing by 0.75 percent in 2017 and by 2-2.5 percent in 2018 and 2019,” the report stated.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

$2,109 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at new buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: absorption rate, class a, class a apartments, delta associates, rental rates in dc, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/although_absorption_still_high_class_a_rents_decline_in_dc_proper/13119.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the residential projects in the works on the Maryland and D... read »

DC and Virginia lead the way in terms of where prices have risen the most this year.... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Bright MLS reported that DC-area home prices approached record highs in March as new ... read »

2709 N Street is a modern, expertly renovated condominium that was built out a of cen... read »

- Malls, Trader Joe's and The 1,400 Units Coming to Friendship Heights

- The 5 DC-Area Zip Codes Where Home Prices Have Appreciated the Most in 2024

- A Look at the Alternatives to a 30-Year Mortgage

- DC-Area Home Prices Nearly Break Record in March

- Three Exclusive Condominiums Debut in Expertly Renovated Georgetown Church

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro