All Cash, No Contingencies: DC’s Housing Market Gets Crazier

All Cash, No Contingencies: DC’s Housing Market Gets Crazier

The two-bedroom at the Ontario in Lanier Heights.

Three of the homes Catherine Czuba sold in the past month were listed for around $1 million. All went under contract in less than a week, and the sellers had plenty of offers to choose from, most of which had the regular combination of attributes that make up a winning bid in DC’s increasingly frenzied market these days: all cash, no contingencies and, of course, an escalation clause.

A potential buyer for one of the homes put her own house on the market when she heard a two-bedroom unit at the Ontario in Lanier Heights was going to be listed. Her home went under contract quickly, but not quickly enough; the offer was contingent on closing the sale at her old house, and the seller took one of the three competing offers instead. It was a competitive pool for the co-op, listed at $885,000: Two of the offers came in around $900,000, one was in the mid-$900,000 range and a fourth escalated to $1 million. Two were all cash with no financing, appraisal or home inspection contingencies.

story continues below

loading...story continues above

“Nobody even touched the $885,000 range,” Czuba told UrbanTurf.

The end result of the other two listings, at 1814 Ontario Place NW and 3414 Porter Street NW, further illustrate what is going on in the DC market. The Ontario Place rowhouse was offered for $985,000; it closes Friday for more than $130,000 above the asking price after drawing in seven offers and going under contract in five days. The home on Porter Street, listed for $992,500, had 11 offers, 7 of which started above the $1 million mark. The home, also under contract in five days, went to an all-cash offer with an escalation clause originally capped at $1.2 million. It sold for more than that.

“The only way we’re going to open up this bottleneck is if we can get more good housing on the market for buyers,” Czuba said.

But more inventory is coming on the market in the DC area, and yet the bottleneck persists. Why?

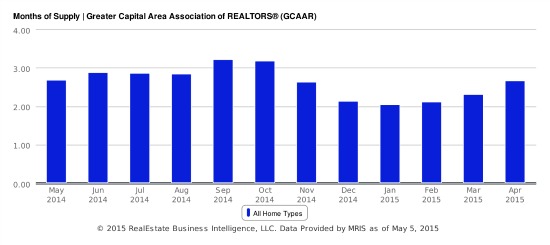

Statistics from RealEstate Business Intelligence (RBI) show that the supply of homes for sale in the DC area market has risen notably over the last several months. New listings in the DC area were at their highest level in 5 years in April. In DC proper, supply is up 4.7 percent over last year. And prices are at their highest level for the month of April since 2007. Despite these metrics, RBI CEO John Heithaus says it’s still “a bullish seller’s market.”

“People start to feel better about real estate,” he said. “Those that purchased coming out of the crash, they’re now seeing appreciation. That encourages more people to not only look but more people to put their houses on the market.”

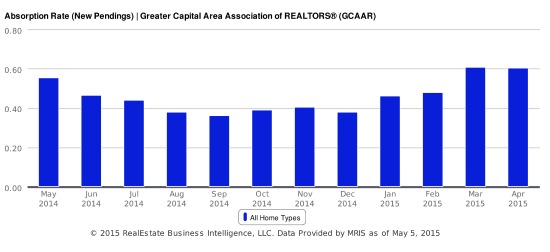

The data back Heithaus up: The metro’s absorption rate last month, measured in new pending sales, was at the highest level since the peak of the housing boom in July 2005.

Buyers are being drawn to market by low interest rates, loosening restrictions on financing and a steadying job market.

“Without demand, it doesn’t really matter what’s else is happening,” Heithaus said. “But here, consumer confidence is strong, job prospects are robust and salaries have been rising. … And young families and millennial families, they’re staying in the District.”

The resulting competition, not the uptick in inventory, is what agents, buyers and sellers are feeling. Compass’ Gordon Harrison, who successfully competed for a house against 16 other offers in recent months, said the market in the region is as hot as he’s seen.

“Nothing has felt as competitive as this past spring,” Harrison told UrbanTurf. “Inventory is really tight, and it hasn’t loosened enough to take the strain.”

Czuba says the crush has left buyers feeling tired, to the point where she is careful not to price a home at a level buyers may perceive as inciting a bidding war.

“Buyers are exhausted,” she said. “They’ve been outbid three, four, five times. They need a break.”

See other articles related to: catherine czuba, housing market, housing market trends, rbi, realestate business intelligence

This article originally published at https://dc.urbanturf.com/articles/blog/all_cash_no_contingency_dcs_crazy_housing_market_gets_crazier/9916.

Most Popular... This Week • Last 30 Days • Ever

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Today, UrbanTurf is examining one of our favorite metrics regarding competition in th... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

- The 4 Projects In The Works Near DC's Starburst Intersection

- What Are the Annual Maintenance Costs When You Own a Home?

- The 6 Places In The DC Area Where You Aren't The Only One Bidding On a Home

- A First Look At The New Plans For Adams Morgan's SunTrust Plaza

- 46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro