The New and Improved Rent v. Buy Calculator

The New and Improved Rent v. Buy Calculator

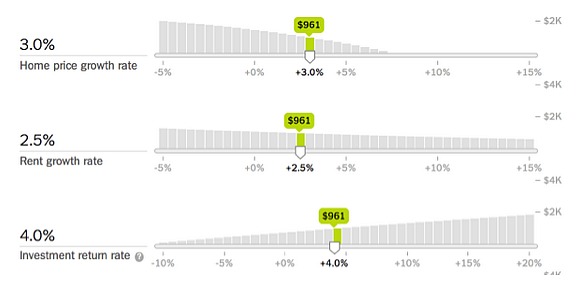

Graphic from The New York Times.

On Thursday, The New York Times ran a series of articles about home buying, many of which highlighted the newspaper’s new and improved Rent vs. Buy calculator. The calculator was created several years ago by graphic editors Kevin Quealy and Archie Tse.

“It is an interactive calculator that uses formulas to calculate the year-by-year costs of buying and renting,” Kevin Quealy told UrbanTurf in 2010. “It then determines which is cheaper after each year.”

Here is how the calculator works. Users input their monthly rent and their desired home price point, in addition to a slew of variables like down payment amount, probable mortgage rate, property taxes, condo fees and the rate of home value appreciation and rent increases in their area. The calculator then creates a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

The new version of the calculator operates the same way, but adds in some important new variables. Now, it allows users to include the annual ROI, the annual inflation rate and the marginal tax rate, and also makes it easier for users to change inputs. Mike Bostock and Shan Carter worked with Archie Tse on the new version.

“The most important new feature is probably the ability of users to dynamically change any of the inputs using a slider and immediately see how it changes their outcome,” Tse wrote to UrbanTurf. “I think it’s surprising to see how much a small change in your outlook on home price appreciation and rent rate increases effects the answer for you. We’ve also been having fun exploring how differences in mortgage rates can affect whether you should have a larger or smaller down payment.”

The one issue that remains with the calculator is that it does not allow you to enter a variable home price appreciation or rent increase percentage. In other words, if a user enters a home price appreciation rate of 5 percent a year, that level of appreciation is assumed for the entire period of the loan.

Also, there are a variety of non-financial intangibles that the calculator does not take into account. Economics reporter Neil Irwin has a great piece on those intangibles out today that frankly any prospective home buyer should read.

UrbanTurf has tested out the calculator at times over the last few years. For those interested in giving it their own test drive, click here.

This article originally published at https://dc.urbanturf.com/articles/blog/the_new_and_improved_rent_v._buy_calculator/8520.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

The owner of 700 Monroe Street NE filed a map amendment application with DC's Zoning ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro