Housing Inventory in DC Area Hits Lowest Level in Almost a Decade

Housing Inventory in DC Area Hits Lowest Level in Almost a Decade

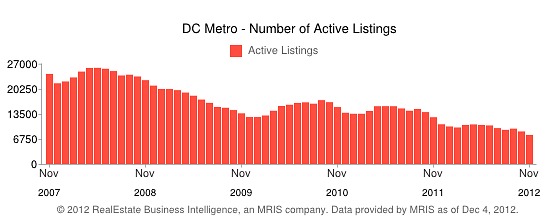

The DC area’s declining inventory.

The DC area finished 2012 with the lowest level of for-sale housing inventory in almost a decade, and the lowest number of new listings on record.

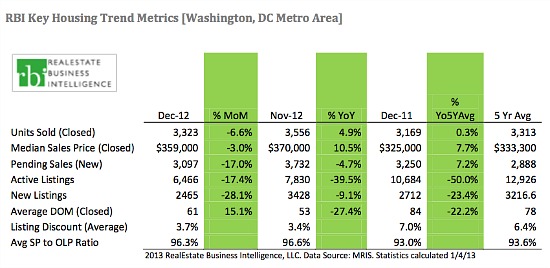

RealEstate Business Intelligence (RBI) reported this morning that there were 6,466 active listings in the region at the end of last year, a drop of over 4,200 listings from the end of 2011. As for new listings, 2,465 came on the market in December, the lowest number for any month with data dating back to 1997.

In general, a drop in inventory usually results in prices heading northward, but at least in the short term, RBI hypothesizes that is not what is happening:

Unseasonable declines in sales and median price from November could be an early sign of weakening demand. While intuitively low supply would put upward pressure on prices, it could be that many buyers are deciding to delay their home purchase until more options become available on the market, which is loosening the pressure on pricing as evidenced by the $11,000 drop in the median sale price from November.

Courtesy of RealEstate Business Intelligence

Still, there is evidence that the drop in inventory over the last 12 months has driven prices upward. In DC proper, the median sales price has risen almost 10 percent (from $414,000 to $455,000), and across the Metro area, prices rose 10.5 percent. During that period, active inventory fell by over 40 percent.

The area that RBI analyzes includes DC, Montgomery County, Prince George’s County, Alexandria City, Arlington County, Fairfax County, Fairfax City, and Falls Church City.

See other articles related to: dc home and condo prices, dc home prices, dc housing inventory, dclofts, housing inventory, realestate business intelligence

This article originally published at https://dc.urbanturf.com/articles/blog/housing_inventory_in_dc_area_hits_lowest_level_in_almost_a_decade/6501.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Plans for the development at a prominent DC intersection began nearly eight years ago... read »

The eight-bedroom, 35,000 square-foot home in McLean originally hit the market in 202... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro