4.50: Mortgage Rates Take a Dip

4.50: Mortgage Rates Take a Dip

Interest rates took a bit of a dip this week.

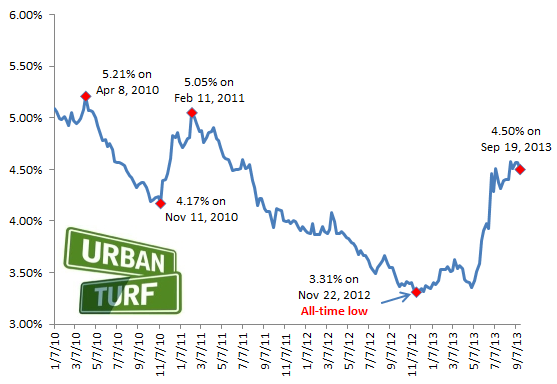

On Thursday morning, Freddie Mac reported 4.50 percent with an average 0.7 point as the average on a 30-year fixed-rate mortgage. Last week, rates averaged 4.57 percent and in August, they hit a yearly high of 4.58 percent.

From Freddie Mac vice president and chief economist Frank Nothaft on today’s rates:

Mortgage rates drifted downwards this week amid signs of a weakening economic recovery. Retail sales rose 0.2 percent in August which was nearly half of July’s 0.4 percent increase. In addition, industrial production in August grew 0.4 percent, less than the market consensus forecast. And lastly, consumer sentiment fell for the second consecutive month in September to the lowest reading since April. This, in part, was why the Federal Reserve chose to maintain its MBS and bond-buying program at its September 12th and 13th monetary policy committee meeting.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: freddie mac, interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/4_50_rates_take_a_dip/7579.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

DC and Virginia lead the way in terms of where prices have risen the most this year.... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

The London-style carriage house was originally built in 1892 as part of the Frasier M... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro