What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

4.40 vs. 3.55: The Difference a Year Makes in Interest Rates

4.40 vs. 3.55: The Difference a Year Makes in Interest Rates

One year ago, the average on a 30-year fixed-rate mortgage was 3.55 percent. On Thursday morning, Freddie Mac reported 4.40 percent with a 0.7 point as the average. So, how would the difference impact your mortgage payments?

Using this $839,000, three-bedroom rowhouse in Kent, we took a look at the difference in monthly payments, based on the today’s interest rates as compared to last year’s.

Let’s assume that in each case, the homeowner puts down 20 percent and takes out a loan for the remaining $671,200.

Here are the two interest rate scenarios.

August 2012: The average mortgage rate was 3.55 percent.

Monthly Mortgage Payment: $3,032

Total Outlay on Mortgage (Payment x 360 months): $1,091,520

August 2013: The average mortgage rate is 4.40 percent.

Monthly Mortgage Payment: $3,361

Total Outlay (Payment x 360 months): $1,209,960

So, the difference between a rate of 3.55 percent and 4.40 percent is about $329 a month or $118,440 over the life of the loan.

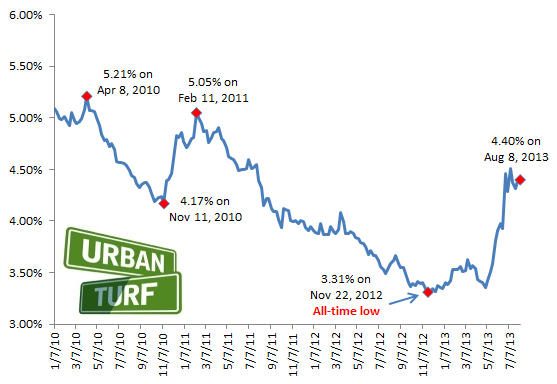

Here’s a look at the path of rates since January 2010:

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/4.40_vs._3.55_the_difference_a_year_makes/7432.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Today, UrbanTurf is examining one of our favorite metrics regarding competition in th... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

- What Are the Annual Maintenance Costs When You Own a Home?

- The 6 Places In The DC Area Where You Aren't The Only One Bidding On a Home

- A First Look At The New Plans For Adams Morgan's SunTrust Plaza

- 46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

- How Much Did DC-Area Rents Rise At The Beginning of 2024?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro