4.20: Mortgage Rates Back Up After Low Point

4.20: Mortgage Rates Back Up After Low Point

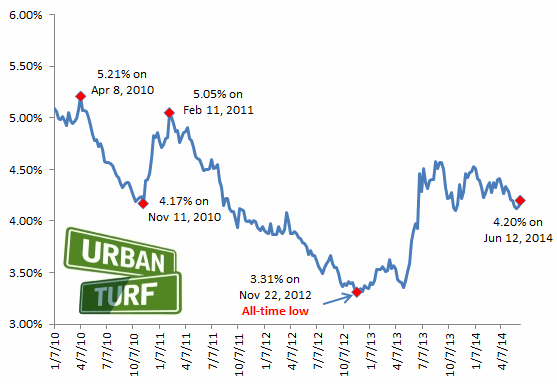

On Thursday, Freddie Mac reported 4.20 percent with an average 0.6 point as the average on a 30-year fixed-rate mortgage, up from 4.14 percent last week. This is the second week in a row that rates have risen after reaching their lowest point since October 2013.

A year ago, rates were 3.23 percent.

Freddie Mac’s chief economist, Frank Nothaft, attributed the rising rates to a good jobs report:

“Mortgage rates continued to climb for the second week in a row following the increase in 10-year Treasury yields. Also, the economy added 217,000 jobs in May, following a 282,000 surge in April and a 203,000 increase in March. Meanwhile, the unemployment rate in May held steady at 6.3 percent.”

We’ve been tracking the rates over time in this chart:

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/4.20_mortgage_rates_pick_back_up_after_low_point/8608.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Plans for the development at a prominent DC intersection began nearly eight years ago... read »

The eight-bedroom, 35,000 square-foot home in McLean originally hit the market in 202... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro