3.9: Mortgage Rates Settle Back Down

3.9: Mortgage Rates Settle Back Down

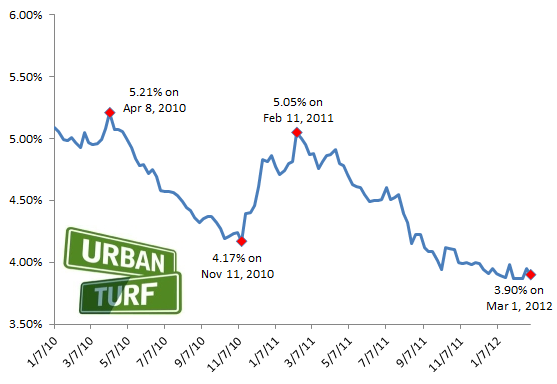

For the past several weeks, mortgage rates have been flirting with going back above 4 percent, but have yet to do so.

This morning, Freddie Mac reported 3.9 percent with an average 0.8 point as the average on a 30-year fixed mortgage, down from last week’s 3.95 percent, but above the record low of 3.87 percent from a few weeks ago. Rates have now been below 4 percent for thirteen consecutive weeks.

From Freddie Mac vice president and chief economist Frank Nothaft:

Fixed mortgage rates bottomed out in January and February of this year which is helping spur the housing market. For instance, pending existing home sales rose in January to its strongest pace since April 2010 and sales figures for December saw upward revisions. In addition, the Federal Reserve noted in its February 29th regional economic review (or Beige Book) that residential real estate activity increased modestly in most of its Districts over the course of January and early February, with several reports of increased home sales.

We have been saying this frequently in past months, but it bears repeating: the rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since last January:

See other articles related to: freddie mac, interest rates, mortgage rates, mortgages

This article originally published at https://dc.urbanturf.com/articles/blog/3.9_mortgage_rates_settle_back_down/5225.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

The owner of 700 Monroe Street NE filed a map amendment application with DC's Zoning ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro