3.36: Another Week, Another Record Low

3.36: Another Week, Another Record Low

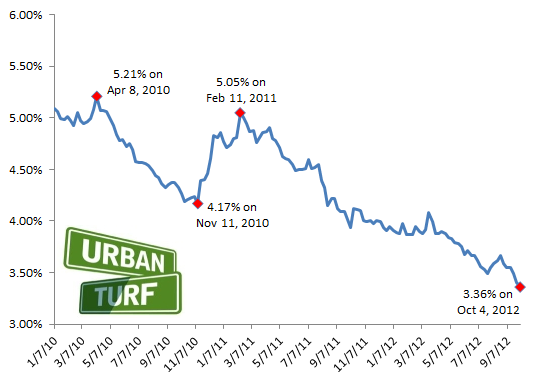

For the second week in a row, mortgage rates dropped considerably to reach a new all-time record low.

This morning, Freddie Mac reported 3.36 percent with an average 0.6 point as the average on a 30-year fixed-rate mortgage.

From Freddie Mac vice president and chief economist Frank Nothaft:

Fixed mortgage rates fell again this week to all-time record lows due to the mortgage securities purchases by the Federal Reserve and indicators of a weakening economy. The final estimate of growth in Gross Domestic Product was revised down to 1.3 percent in the second quarter, representing the slowest growth in a year. In addition, personal incomes rose only 0.1 percent in August, while July’s increase was revised downward. And finally, pending home sales in August fell 2.6 percent, well below the market consensus forecast of a slight increase.

Will rates drop below 3 percent? Earlier this week, we tapped a few experts to give us some insight into the possibility of that happening. Check it out here.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/3.36_another_week_another_record_low/6116.

Most Popular... This Week • Last 30 Days • Ever

DC's homebuyer assistance programs can be a bit complex. This edition of First-Timer ... read »

When it comes to financing a home purchase, a 30-year mortgage is one of the most com... read »

Pocket listings are growing in popularity in the low-inventory market in the DC regio... read »

Margarite is a luxury 260-apartment property known for offering rich, high-end reside... read »

The owner of 700 Monroe Street NE filed a map amendment application with DC's Zoning ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro